(Part 10)

It’s sovereignty you can hold (well, digitally). But slotting it into your trust? That’s where it gets fun—and secure. We’re skipping single wallets for a multisig setup: multiple keys, split smartly

Bitcoin in Your Trust—Multisig Mastery for Your Legacy

Bitcoin’s your sound money ace—$80,000 a pop in 2025, free from fiat’s fade and central bank claws. It’s sovereignty you can hold (well, digitally). But slotting it into your trust? That’s where it gets fun—and secure. We’re skipping single wallets for a multisig setup: multiple keys, split smartly, so your Trustee can distribute it to Beneficiaries without risking it all. Here’s how to lock in your BTC and pay it out, step by step.

Why Multisig for Your Trust?

A single key’s a single point of failure—lose it, and your 1 BTC ($80K) vanishes. Multisig (multi-signature) needs two or more keys to move funds, like a bank vault with dual locks. It’s perfect for trusts: protects your Bitcoin from hacks, theft, or a Trustee gone rogue, while keeping distributions smooth. Your kids get their share, and you sleep easy.

Setting Up Bitcoin in a Multisig Trust

- Pick Your Multisig Setup:

- Go for a 2-of-3 multisig: three keys total, two needed to spend.

- Key 1: Trustee holds it—your Moses, managing the trust.

- Key 2: A trusted third party holds it—think Unchained Capital, a Bitcoin custody pro, or a family lawyer.

- Key 3: Beneficiary holds it, or it’s stashed in a $50/year safe deposit box (split seed phrase if you’re extra cautious).

- Create the Wallet:

- Use a trusted multisig platform—Unchained Capital offers setups, or try open-source tools like Sparrow Wallet. Fund it with BTC (e.g., 0.5 BTC, ~$40K).

- Generate the three keys, store each securely: Trustee’s in a safe, third party’s with them, third in a deposit box or with a Beneficiary.

- Transfer to the Trust:

- List it in Article 4 (Trust Property): “Multisig Bitcoin wallet holding 0.5 BTC, 2-of-3 keys managed by Trustee [Name], third party [Name/Entity], and [Beneficiary Name or ‘safe deposit box at First Bank’].”

- Secure the Keys:

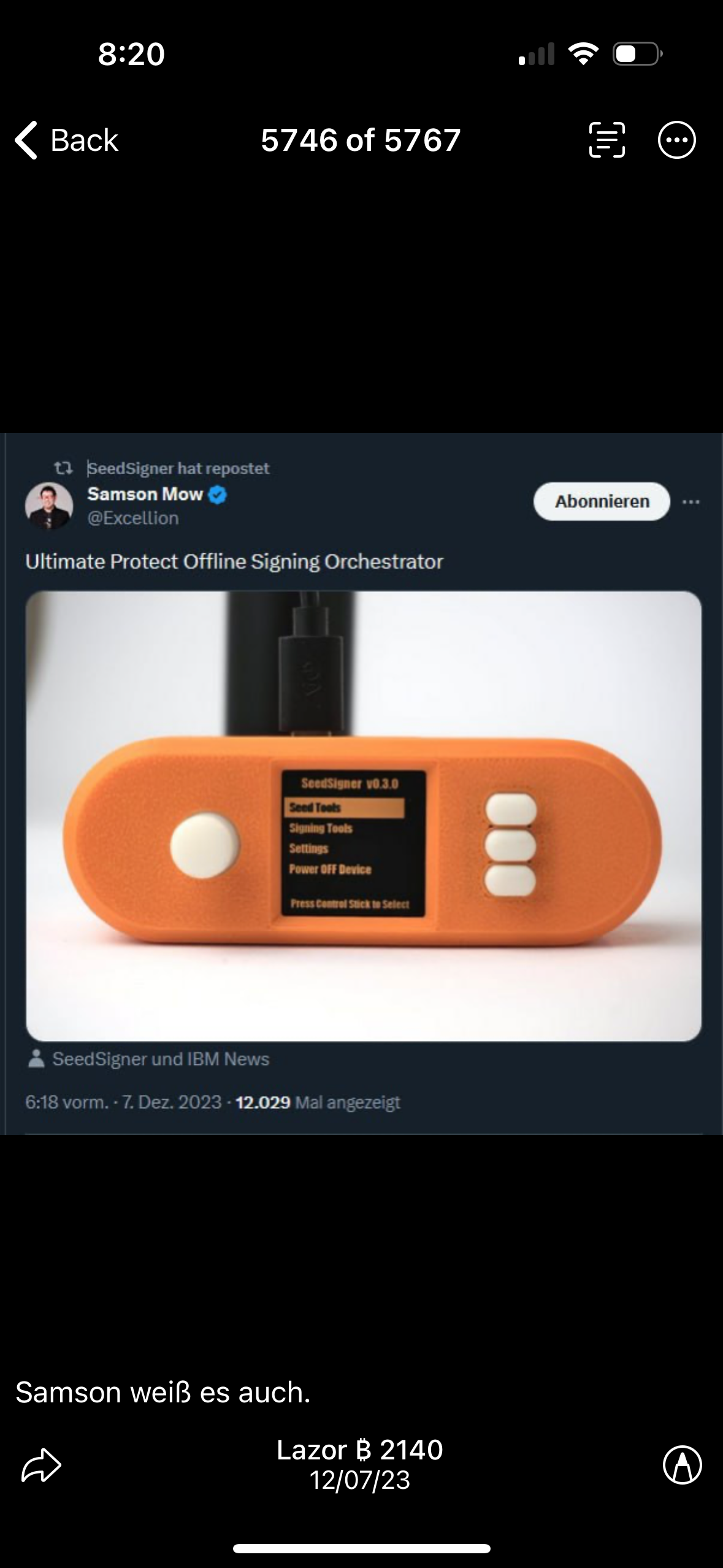

- Each holder gets a hardware wallet (pick a community fave—no names here!) or paper seed phrase. Back up seeds in separate spots—fireproof safe, vault, trusted hands.

- If a key’s lost (Trustee dies, box floods), the other two still unlock it—your BTC’s safe.

Distribution Examples

Your Trustee and third party team up to sign transactions—here’s how payouts might look, tweakable in Article 6:

- Direct BTC Transfer (Small Trust, $40,000)

- Setup: 0.5 BTC in a 2-of-3 multisig, revocable trust.

- Rule: “Upon my death, Trustee distributes 0.25 BTC to John Doe and 0.25 BTC to Sarah Doe.”

- How: Trustee and third party (e.g., Unchained) sign a transaction—0.25 BTC to each Beneficiary’s private wallet (they provide addresses).

- Why: Clean crypto handoff—Beneficiaries hold or sell as they choose.

- Cash Withdrawals (Medium Trust, $250,000)

- Setup: 3 BTC in an irrevocable trust.

- Rule: “Trustee pays $10,000 annually to each Beneficiary (John, Sarah) from BTC sales until age 30.”

- How: Trustee and third party (e.g., a bank partner) sell 0.25 BTC (~$20K at $80K/BTC), split $10K cash to each via bank transfer. Repeats yearly.

- Why: Converts BTC to fiat—steady income, no crypto overwhelm for Beneficiaries.

- Hybrid Payout (Large Trust, $1M)

- Setup: 12 BTC in an irrevocable trust.

- Rule: “Trustee pays $25,000 cash yearly per Beneficiary (John, Sarah) from BTC sales until 35, then splits remaining BTC.”

- How: Trustee and third party sell 0.625 BTC/year ($50K), send $25K each. After 10 years, ~5.75 BTC left—signed to Beneficiaries’ wallets (2.875 BTC each).

- Why: Cash now, crypto later—balances immediate needs with BTC’s growth (maybe $120K by 2035).

Try It Out

Start with 0.1 BTC ($8,000) in a 2-of-3 setup—Trustee, a friend, and a deposit box. Test a $500 payout. Sovereign, sound, and smarter than a single key. What’s your Bitcoin play?

- Multisig: Good with 2-of-3, or tweak (e.g., 3-of-5)?

- Third Party: Unchained Capital (e.g., Casa, BitGo)?

- Examples: Happy with payouts, or adjust amounts/rules?